On the evening of April 28, KEDA Industrial Group (600499.SH) released its first periodic report for 2025. Staying committed to its "Globalization" strategy and focusing on core business development, KEDA Industrial Group posted operating revenue of RMB 3.767 billion in Q1 2025, up 47.05% YoY. Net profit attributable to shareholders of the listed company reached RMB 347 million, up 11.38% YoY. Net profit attributable to shareholders of the listed company excl. non-recurring profit or loss reached RMB 323 million, up 17.13% YoY.

Excluding the impact of foreign exchange losses, KEDA Industrial Group's actual net profit attributable to shareholders of the listed company stood at RMB 412 million, reflecting a steady improvement in core business profitability.

Ceramic Machinery Business Expands Steadily, Accelerating Global Penetration

Since the beginning of 2025, KEDA Industrial Group has doubled down on its globalization strategy in response to an increasingly complex trade environment. By strengthening international localization, expanding its global marketing network, and growing its spare parts & consumables business, the company has enhanced its global service capabilities & risk resilience.

Despite pressures from cyclical demand slowdown, intensified market competition, and adjustments in customer investment pace, the ceramic machinery business faced short-term headwinds in the first quarter, with a slight decline in overall performance.

▲ KEDA Industrial Group successfully signed multiple cooperation agreements with the Arwana Group

However, industry experts note that these short-term challenges have not altered the segment's underlying growth trajectory. With ongoing improvements in core competitiveness and a broader service offering across the ceramic production chain & general industries, KEDA Industrial Group is poised to further expand its global market share and business scale.

Building Materials Capacity Advances Steadily, Profitability Strengthened Through Multiple Initiatives

The building materials business showed strong growth potential. Despite an increase in foreign exchange losses due to currency fluctuations, operating revenue from this segment recorded a significant rise. This was driven by the expansion of the building glass business, the ramp-up of building ceramics production, and optimized pricing strategies. Gross profit margin also improved notably YoY. Excluding the impact of foreign exchange losses, the overall profitability of the segment showed significantgrowth.

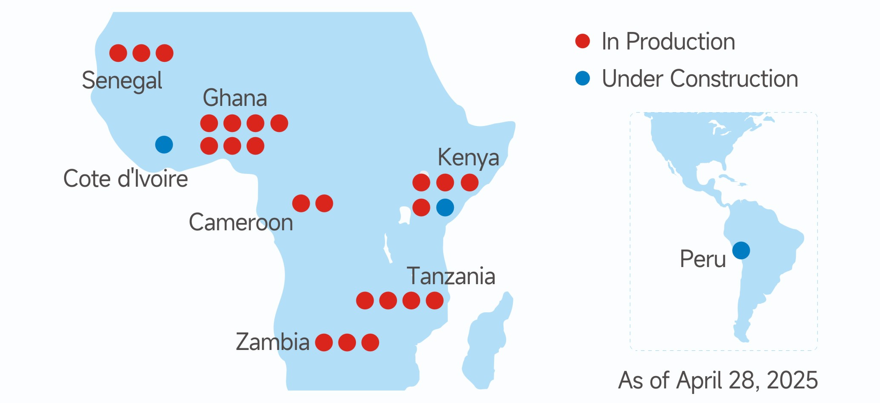

Furthermore, KEDA Industrial Group is steadily advancing capacity expansion projects. The ceramic projects in Côte d'Ivoire and Kenya are expected to complete construction or upgrades within this year. Construction of the building glass project in Peru is also progressing well and is scheduled to start production in 2026.

With the gradual release of new production capacity and ongoing efforts to cut costs and boost efficiency, the building materials business is poised for broader growth over the long term.

Lanke Lithium Industry Maintains Strong Cost Advantage, Continuing to Deliver Stable Returns

In strategic investments, KEDA Industrial Group's associate company, Lanke Lithium Industry, produced approximately 8,500 tons of lithium carbonate and sold around 8,100 tons during the quarter. It generated operating revenue of RMB 528 million and net profit of RMB 207 million, contributing RMB 90 million in net profit attributable to shareholders of the listed company.

Despite lithium carbonate prices remaining volatile during the reporting period, Lanke Lithium Industry maintained a strong cost advantage, consistently delivering stable investment returns for KEDA Industrial Group.

Amid a highly unpredictable international environment, companies are tested not only on strategic focus but also on resilience and operational strength. KEDA Industrial Group remains firmly committed to its core business, accelerates global localization efforts, and strengthens operational management. With these efforts, the company is well-positioned to seize new opportunities and achieve greater heights.

(Securities Times)

loading...

loading... 30 Apr 2025

30 Apr 2025